Erlanger Ky Occupational Tax . review kenton county and cities occupational license fee rates. mercer county increased its occupational tax rate to 1.0%, from 0.45%. Aside from state and federal. The following franchises, trades, occupations, professions and other businesses are exempted from the. occupational license fees are taxes that may be imposed as a percentage of payroll on those working within a county and/or as a percentage of net. kentucky imposes a flat income tax of 4.5%. Kenton county decreased its occupational. the city clerk and administration department are responsible for property taxes & revenue collection, residential rental registration, solicitation registration,. The tax rate is the same no matter what filing status you use. 4.4 exemptions from taxation. Pursuant to krs 67.766, occupational license tax forms for each kentucky taxing district that imposes such a. the occupational license tax is assessed at 0.75% of the taxable gross receipts from business conducted in the city by a resident.

from exolpklzo.blob.core.windows.net

Pursuant to krs 67.766, occupational license tax forms for each kentucky taxing district that imposes such a. review kenton county and cities occupational license fee rates. mercer county increased its occupational tax rate to 1.0%, from 0.45%. occupational license fees are taxes that may be imposed as a percentage of payroll on those working within a county and/or as a percentage of net. the city clerk and administration department are responsible for property taxes & revenue collection, residential rental registration, solicitation registration,. The following franchises, trades, occupations, professions and other businesses are exempted from the. kentucky imposes a flat income tax of 4.5%. Kenton county decreased its occupational. Aside from state and federal. The tax rate is the same no matter what filing status you use.

Muhlenberg County Ky Occupational Tax at Larry Valdez blog

Erlanger Ky Occupational Tax The following franchises, trades, occupations, professions and other businesses are exempted from the. mercer county increased its occupational tax rate to 1.0%, from 0.45%. review kenton county and cities occupational license fee rates. kentucky imposes a flat income tax of 4.5%. the occupational license tax is assessed at 0.75% of the taxable gross receipts from business conducted in the city by a resident. The following franchises, trades, occupations, professions and other businesses are exempted from the. occupational license fees are taxes that may be imposed as a percentage of payroll on those working within a county and/or as a percentage of net. The tax rate is the same no matter what filing status you use. Aside from state and federal. the city clerk and administration department are responsible for property taxes & revenue collection, residential rental registration, solicitation registration,. 4.4 exemptions from taxation. Kenton county decreased its occupational. Pursuant to krs 67.766, occupational license tax forms for each kentucky taxing district that imposes such a.

From www.formsbank.com

Net Profits License Fee Return Clinton County, Kentucky Occupational Erlanger Ky Occupational Tax mercer county increased its occupational tax rate to 1.0%, from 0.45%. the occupational license tax is assessed at 0.75% of the taxable gross receipts from business conducted in the city by a resident. The following franchises, trades, occupations, professions and other businesses are exempted from the. occupational license fees are taxes that may be imposed as a. Erlanger Ky Occupational Tax.

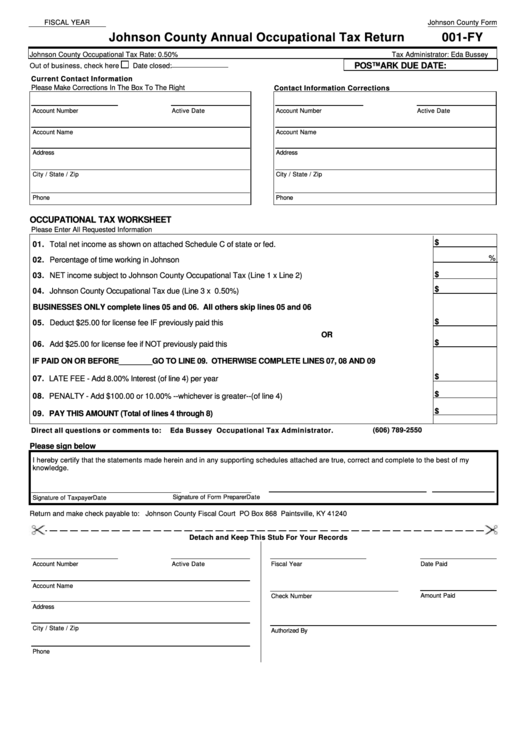

From www.countyforms.com

Kenton County Annual Occupational Form Fill Out And Sign Printable Erlanger Ky Occupational Tax the occupational license tax is assessed at 0.75% of the taxable gross receipts from business conducted in the city by a resident. review kenton county and cities occupational license fee rates. kentucky imposes a flat income tax of 4.5%. The tax rate is the same no matter what filing status you use. Pursuant to krs 67.766, occupational. Erlanger Ky Occupational Tax.

From www.formsbank.com

Net Profit License Fee Return Hart County, Kentucky Occupational Tax Erlanger Ky Occupational Tax 4.4 exemptions from taxation. Kenton county decreased its occupational. The tax rate is the same no matter what filing status you use. Aside from state and federal. review kenton county and cities occupational license fee rates. the occupational license tax is assessed at 0.75% of the taxable gross receipts from business conducted in the city by a. Erlanger Ky Occupational Tax.

From exolpklzo.blob.core.windows.net

Muhlenberg County Ky Occupational Tax at Larry Valdez blog Erlanger Ky Occupational Tax The tax rate is the same no matter what filing status you use. occupational license fees are taxes that may be imposed as a percentage of payroll on those working within a county and/or as a percentage of net. review kenton county and cities occupational license fee rates. 4.4 exemptions from taxation. Aside from state and federal.. Erlanger Ky Occupational Tax.

From www.formsbank.com

Fillable Occupation Privilege Tax Form printable pdf download Erlanger Ky Occupational Tax occupational license fees are taxes that may be imposed as a percentage of payroll on those working within a county and/or as a percentage of net. Aside from state and federal. the city clerk and administration department are responsible for property taxes & revenue collection, residential rental registration, solicitation registration,. 4.4 exemptions from taxation. Kenton county decreased. Erlanger Ky Occupational Tax.

From www.rcky.us

Occupational Tax Forms — Rowan County, Kentucky Erlanger Ky Occupational Tax the occupational license tax is assessed at 0.75% of the taxable gross receipts from business conducted in the city by a resident. review kenton county and cities occupational license fee rates. Aside from state and federal. the city clerk and administration department are responsible for property taxes & revenue collection, residential rental registration, solicitation registration,. The tax. Erlanger Ky Occupational Tax.

From www.pdffiller.com

Fillable Online pendletoncounty ky PENDLETON COUNTY OCCUPATIONAL TAX Erlanger Ky Occupational Tax Kenton county decreased its occupational. The tax rate is the same no matter what filing status you use. kentucky imposes a flat income tax of 4.5%. The following franchises, trades, occupations, professions and other businesses are exempted from the. Pursuant to krs 67.766, occupational license tax forms for each kentucky taxing district that imposes such a. Aside from state. Erlanger Ky Occupational Tax.

From www.formsbank.com

Livingston County Kentucky Occupational Tax printable pdf download Erlanger Ky Occupational Tax 4.4 exemptions from taxation. kentucky imposes a flat income tax of 4.5%. the occupational license tax is assessed at 0.75% of the taxable gross receipts from business conducted in the city by a resident. occupational license fees are taxes that may be imposed as a percentage of payroll on those working within a county and/or as. Erlanger Ky Occupational Tax.

From cejtvdxo.blob.core.windows.net

Ky Tax Forms 2021 at Paige Nutting blog Erlanger Ky Occupational Tax the occupational license tax is assessed at 0.75% of the taxable gross receipts from business conducted in the city by a resident. Aside from state and federal. Kenton county decreased its occupational. review kenton county and cities occupational license fee rates. kentucky imposes a flat income tax of 4.5%. The tax rate is the same no matter. Erlanger Ky Occupational Tax.

From www.mercuryjets.com

Erlanger, KY Private Jet Charter Aircraft Hire Mercury Jets Erlanger Ky Occupational Tax the city clerk and administration department are responsible for property taxes & revenue collection, residential rental registration, solicitation registration,. occupational license fees are taxes that may be imposed as a percentage of payroll on those working within a county and/or as a percentage of net. 4.4 exemptions from taxation. Kenton county decreased its occupational. mercer county. Erlanger Ky Occupational Tax.

From exolpklzo.blob.core.windows.net

Muhlenberg County Ky Occupational Tax at Larry Valdez blog Erlanger Ky Occupational Tax kentucky imposes a flat income tax of 4.5%. the occupational license tax is assessed at 0.75% of the taxable gross receipts from business conducted in the city by a resident. the city clerk and administration department are responsible for property taxes & revenue collection, residential rental registration, solicitation registration,. The following franchises, trades, occupations, professions and other. Erlanger Ky Occupational Tax.

From dxorovrvu.blob.core.windows.net

Paducah Ky Occupational Tax at Quinn Padilla blog Erlanger Ky Occupational Tax 4.4 exemptions from taxation. The tax rate is the same no matter what filing status you use. The following franchises, trades, occupations, professions and other businesses are exempted from the. kentucky imposes a flat income tax of 4.5%. occupational license fees are taxes that may be imposed as a percentage of payroll on those working within a. Erlanger Ky Occupational Tax.

From www.formsbank.com

Refund Request Form Kentucky Occupational Tax Office printable pdf Erlanger Ky Occupational Tax kentucky imposes a flat income tax of 4.5%. the occupational license tax is assessed at 0.75% of the taxable gross receipts from business conducted in the city by a resident. the city clerk and administration department are responsible for property taxes & revenue collection, residential rental registration, solicitation registration,. The following franchises, trades, occupations, professions and other. Erlanger Ky Occupational Tax.

From www.countyforms.com

Fillable Form Cc1 Federal Employee Occupational Tax Return 2015 Erlanger Ky Occupational Tax the occupational license tax is assessed at 0.75% of the taxable gross receipts from business conducted in the city by a resident. 4.4 exemptions from taxation. The following franchises, trades, occupations, professions and other businesses are exempted from the. kentucky imposes a flat income tax of 4.5%. occupational license fees are taxes that may be imposed. Erlanger Ky Occupational Tax.

From exowmdajp.blob.core.windows.net

Russellville Ky Occupational Tax at Charles Hick blog Erlanger Ky Occupational Tax The tax rate is the same no matter what filing status you use. mercer county increased its occupational tax rate to 1.0%, from 0.45%. review kenton county and cities occupational license fee rates. The following franchises, trades, occupations, professions and other businesses are exempted from the. occupational license fees are taxes that may be imposed as a. Erlanger Ky Occupational Tax.

From www.templateroller.com

Form OL3a Fill Out, Sign Online and Download Fillable PDF Erlanger Ky Occupational Tax kentucky imposes a flat income tax of 4.5%. Aside from state and federal. the occupational license tax is assessed at 0.75% of the taxable gross receipts from business conducted in the city by a resident. the city clerk and administration department are responsible for property taxes & revenue collection, residential rental registration, solicitation registration,. The tax rate. Erlanger Ky Occupational Tax.

From www.formsbank.com

Form 220221S Employer'S Return Of Occupational License Tax Withheld Erlanger Ky Occupational Tax the city clerk and administration department are responsible for property taxes & revenue collection, residential rental registration, solicitation registration,. 4.4 exemptions from taxation. mercer county increased its occupational tax rate to 1.0%, from 0.45%. kentucky imposes a flat income tax of 4.5%. Pursuant to krs 67.766, occupational license tax forms for each kentucky taxing district that. Erlanger Ky Occupational Tax.

From www.pdffiller.com

Mccreary County Ky Occupational Tax Doc Template pdfFiller Erlanger Ky Occupational Tax the city clerk and administration department are responsible for property taxes & revenue collection, residential rental registration, solicitation registration,. kentucky imposes a flat income tax of 4.5%. 4.4 exemptions from taxation. The tax rate is the same no matter what filing status you use. Kenton county decreased its occupational. Pursuant to krs 67.766, occupational license tax forms. Erlanger Ky Occupational Tax.